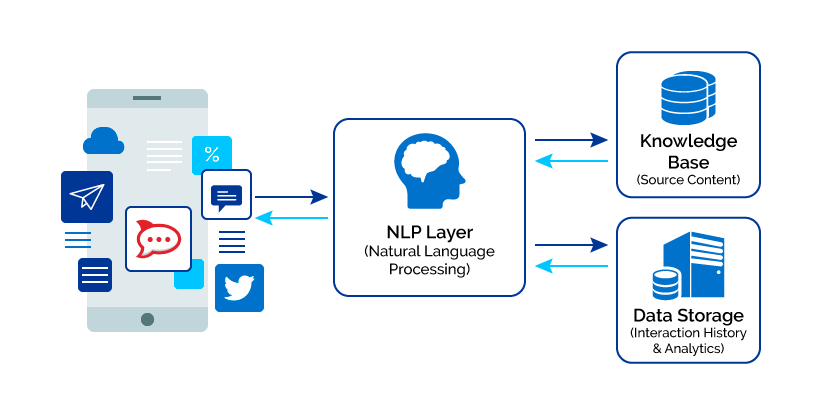

Client is a FinTech Firm operating Prime Brokerage Business for WholeSale and Retail Markets. Ezapp delivered the powerful AI Automation Solution that allowed the company to identify Sales Growth Channels and Predicted Sales/bid Pricing for Profitability optimization. Ezapp developed NLP suite using Machine Learning models for automation of the Prime Services workflow, Sales Forecast Predictions, Securities Pricing Predictions, Business Revenue Optimization and Profitability predictions.

FinTech Company utilized existing framework of Collateral Management through Trade Portfolio to

have View of the

Sourced and Used Securities but the Firm was not able to manage the Margins accurately for Prime

Services. Firm required

state of the art Artificial Intelligence to automate the Collateral Management and Optimize AFS

portfolio through NLP automation.

Ezapp provided the AI automation solution to the Client by forecasting of Sales and Bid Pricing of the Securities. NLP Automation service allowed Trader to give NLP instructions to obtain the View on Collateral and System will generate Real-Time View of the Securities with Encumberance and Re-hypothecation. Solution delivered was full automation of the Collateral Mangement workflow from Inventory Management, Lending Securities, Pricing Securities and Allocation service for Asset Liability.

Ezapp Solution provided the Dashboard for Client to manage different Categories of Securities and its Collateral in most effective manner.Machine Learning models deployed enhanced Client's probability to increase sales and automate the Prime Brokerage Business workflow.

EzappSolution is onshore and offshore product development partner for mission-driven technology startups across the globe. We combine business expertise and cutting-edge technology to drive success for our customers and help them win in their chosen markets.

projects delivered

remotely

of a team senior

and middle engineers

employee turnover

rate

customer satisfaction

score

© 2023 Copyright. All rights reserved.