Client is a FinTech Company which lends Credit Cards to Customers based on Financial profile. AI Platform built helps FinTech company to screen customers using the AI. Ezapp delivered the powerful AI Solution that allowed the company to identidy any Fraud Customers and Predict the Customers which were about to become defaulters in advance. Ezapp developed using Machine Learning models Lending Predictions, Loan Loss Predictions, Loan Recovery Rates Predictions, Business Revenue Optimization and Profitability predictions.

FinTech company having operations in London and New York was struggling with growing challenge of

Credit Card Fraud Transactions.

Leading business indicators pointed drop in the recovery rates as well as there was lack of

insights on the lending performance

of both Retail loans portfolio. Firm was struggling to form the team of Data Scientist to manage

the pipeline of growing business

and reduce the Operational risk by enhacing the Risk capabilities through Artificial Intelligence

as there were limited resources

having the expertize both in Finance domain and Ai.

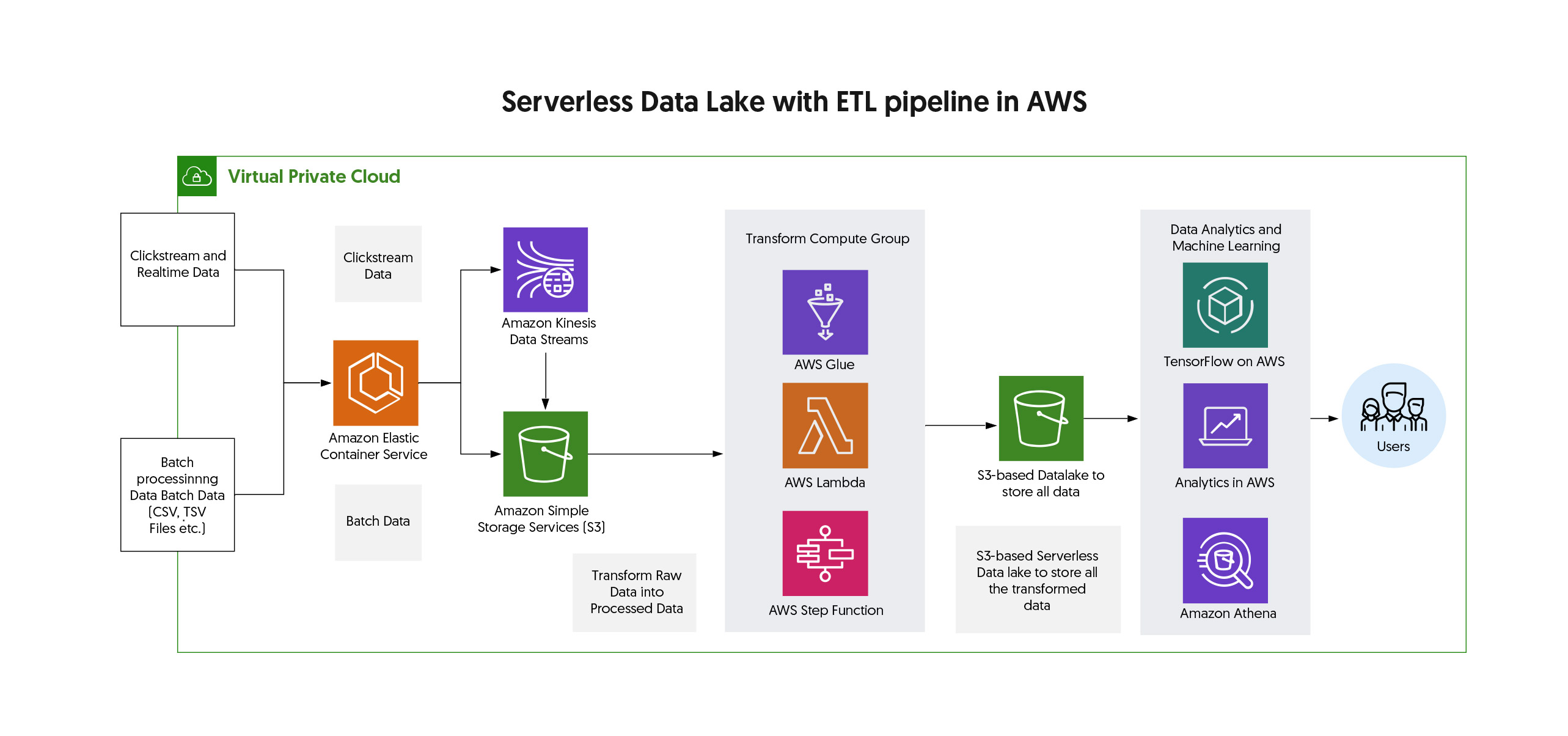

Ezapp’s Enterprise Payments Fraud uses advance Deep learning AI models which considers robust behavioral profiling, anomaly detection and machine learning analytics for identification of loan and credit card transaction fraud. Using advance AI Tensorflow models, Ezapp has developed fraud detection accurately and efficiently, this allows timely detection of the payment frauds so that Financial Firm can benefit from payment risk and improve the governance of the transactions with ease by leveraging AI solution.

Credit Card Fraud Detection Solution Ezapp’s Card Fraud provides adaptive solutions for real-time detection and prevention of credit card fraud. The end-to-end process is thus managed, from detection to investigation to resolution, within a single financial fraud Management platform.

The Ezapp Payments Fraud solution enables holistic protection against payment fraud in the open

banking ecosystem

by combining both monetary and non-monetary activity information to derive more accurate fraud risk

indicators.

It provides broad coverage for cross-channel payments, automates interdiction to block fraudulent

payments in real-time

and minimises impact to your institution and customers.

EzappSolution is onshore and offshore product development partner for mission-driven technology startups across the globe. We combine business expertise and cutting-edge technology to drive success for our customers and help them win in their chosen markets.

projects delivered

remotely

of a team senior

and middle engineers

employee turnover

rate

customer satisfaction

score

© 2023 Copyright. All rights reserved.