FinTech Firm required Potfolio Re-balancing automation based on Artificial Intelligence. Firm had tried in the past Solutions based on Quantitative Trading but it was not fullfilling the Business Intelligence required to drive the automation of the Portfolio Optimization. Ezapp Solution developed the complete suite of Portfolio Optimization involving AI Recommender System to allow Traders to Buy/Sell/Hold trades and automatically balance the Portfolio based on Market riks, Liquidity risk and Credit risk.

Stock prices are heavily influenced by economic events, company/Industry performance and market sentiments.

Sentiments on Twitter and Social Paltform drive the Trading behavior. Negative the Sentiments, Traders short the Trade. Positve

the Sentiments on earning forecast or Market expansion, Traders are Long on Positions. Financial Institution lacks the capability

to determine in Real-time Sentiments on Thousand of Trades.

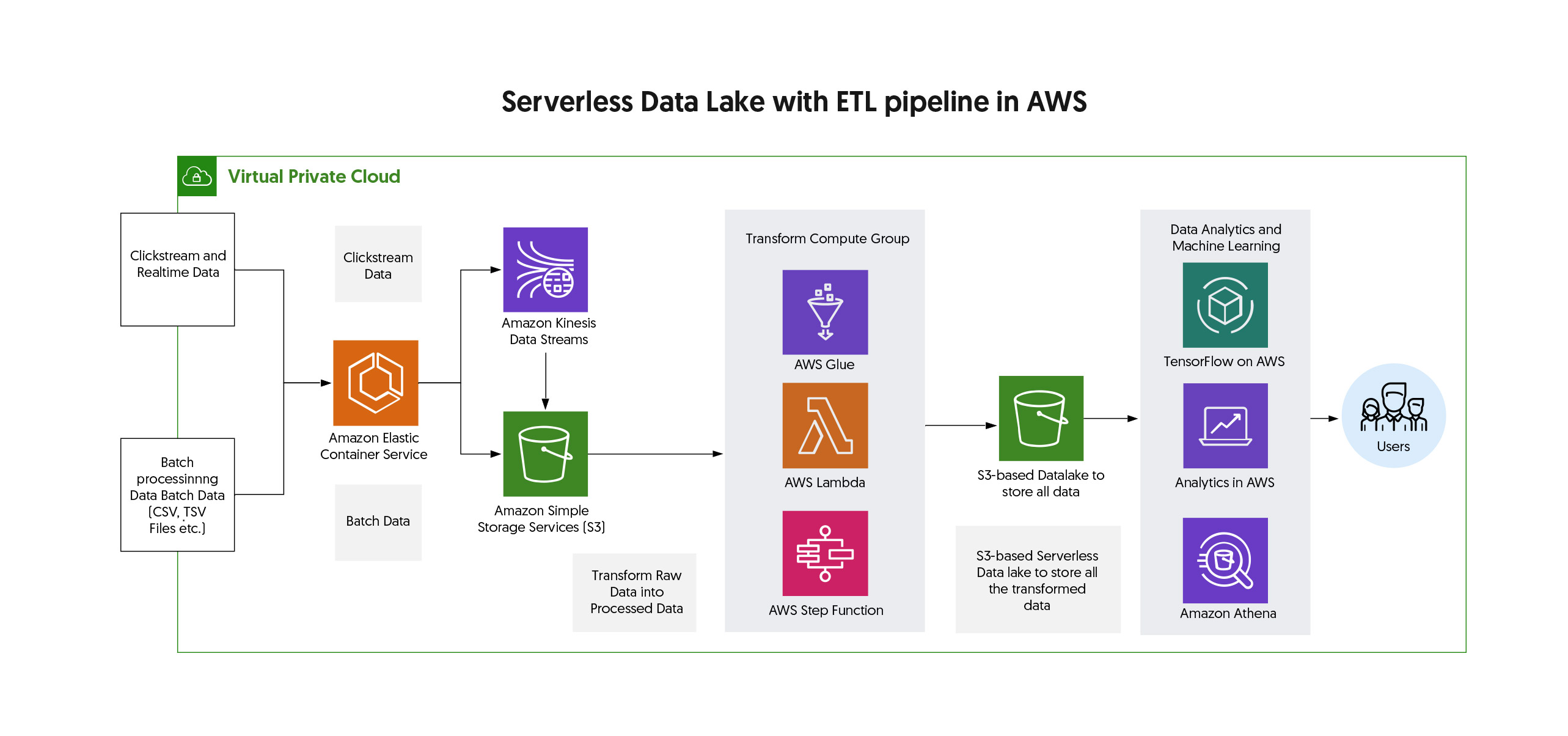

Ezapp has delivered Sentiment Analyzer platform to allow Trades to make Trading decisions. Tool comes with Heat Map that shows Trades that are likely to be impacted on pricing Volatility Vs Trades which are likely to Yield higher Returns. Ezapp Sentiment Analyzer tool allows trades to Optimize the Holdings Positions and Maximize Profits through Sentiment Analysis. We use Deep learning models using Tensorflow to determine the indicative information on Stocks for Buys/Sells/Hold Strategies.

Ezapp built the AI Models:

EzappSolution is onshore and offshore product development partner for mission-driven technology startups across the globe. We combine business expertise and cutting-edge technology to drive success for our customers and help them win in their chosen markets.

projects delivered

remotely

of a team senior

and middle engineers

employee turnover

rate

customer satisfaction

score

© 2023 Copyright. All rights reserved.